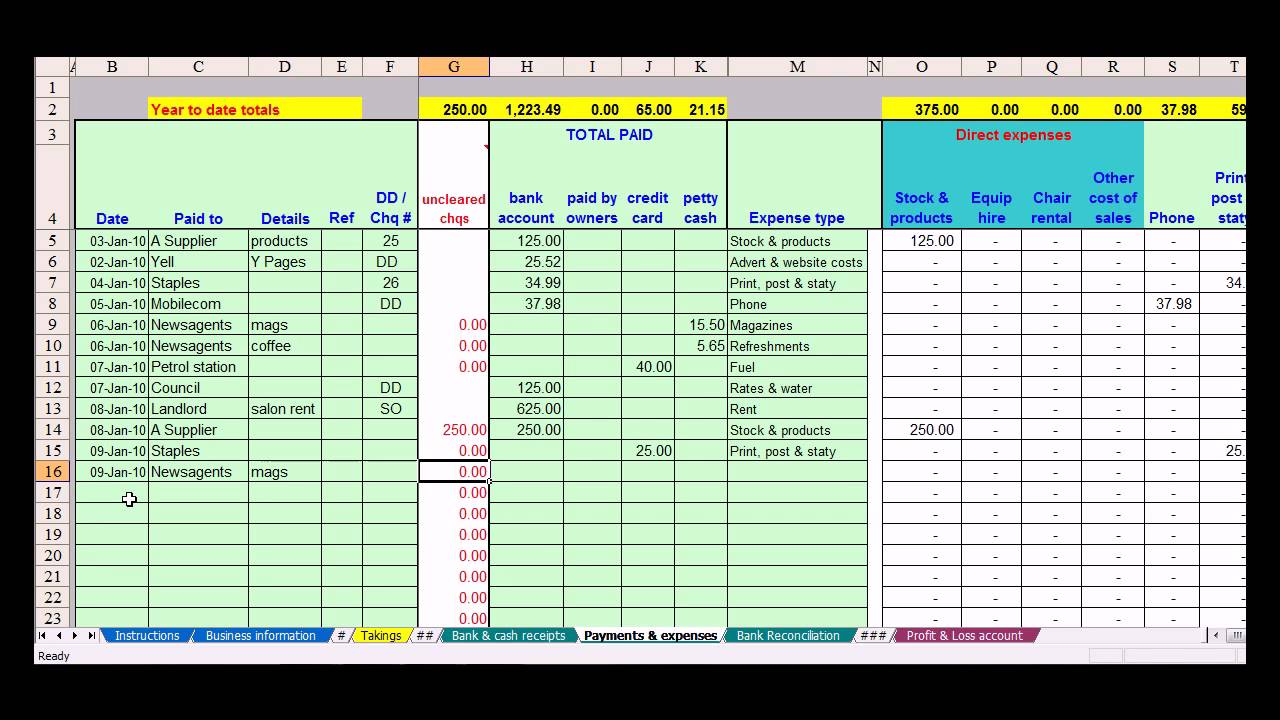

Type of Accountĭouble-entry bookkeeping is a system of accounting in which for every transaction, one account is debited, and one account is credited, and the accounting equation is a fundamental part of this system. The debits and credits for each individual transaction should add up to zero. In contrast, liability, equity, and revenue accounts increase when they are credited.ĭebits will be recorded on the left side of an entry, and credits will be recorded on the right side of an entry. If a transaction occurred in which your assets increased, this would require a debit to the asset account involved.Īdditionally, the same transaction would require a credit to the other account involved in the transaction.Įxpense accounts and asset accounts will increase when they are debited. These transactions record the money moving in and out of your business. In a double-entry accounting system, with each transaction, one account will be debited, and another account will be credited. They can see exactly where any money is coming from and going to. DateĪ double-entry accounting system provides business owners with more information about their business. The following journal entries will show what the above transactions would look like in a double-entry accounting system. This Lack of information is why most businesses do not use single entry accounting. The business also paid its electric bill, but it is not clear whether the business still has a balance with the electric company or not. The owner can see that the business made $1,000 from a customer, but it is unclear whether the customer was paying off their entire account or whether they still owe money to the business. This example will include a customer paying their bill, and the business paying its electric bill. You will enter a date, a description, the amount of the transaction, and the balance in your records.

It is difficult to determine the actual profit or loss occurring in a business.A single entry accounting system is less expensive for a business to maintain than a double-entry accounting system.It is easy to determine a business’s profits.

We are going to list both the advantages and disadvantages of a single entry accounting system. However, there are some advantages to having a single entry accounting system for particularly small businesses.

DOUBL ENTRY BOOKKEEPING EXAMPLES SOFTWARE

This is different than single-entry accounting, in which only expenses and revenue are tracked.ĭouble-entry accounting tracks liabilities, equity, and assets as well as revenue and expenses.ĭouble-entry accounting does involve more work, but it also gives a better picture of how money is flowing through a business.Īlso, considering the amount of accounting software available today, double-entry accounting is not nearly as difficult as it used to be.Īdvantages and Disadvantages of Single Entry AccountingĪ single-entry accounting system is better for most businesses. If the debit and the corresponding credits for each transaction add up to zero, the business’s books remain balanced. Double-entry accounting requires two entries for each transaction, a debit, and a credit.

0 kommentar(er)

0 kommentar(er)